Exploring Common Issues with the Rise of Digital Asset NFTs

Exploring Common Issues with the Rise of Digital Asset NFTs

Quick Links

NFTs are all the rage among aficionados of cryptocurrency and collectors alike, not to mention those who like to try their luck on the cutting edge of tech. However, as with all things new, there’s a risk with NFTs, one that can turn the cutting edge into the bleeding edge.

What Are NFTs?

Non-fungible tokens are a type of asset that exists purely in digital form. Like cryptocurrency—to which it’s pretty closely related, something we go into in our full explainer on NFTs -–record of ownership is kept in a blockchain and a digital ledger.

Related: What Are NFTs? Meet Crypto’s Digital Collectibles

Unlike cryptocurrency, though, NFTs are one of a kind: non-fungible means that they’re not interchangeable with each other. This makes each and every NFT unique, in contrast to cryptocurrencies where each unit or coin can be exchanged for another—much the same goes for real-world currencies, too.

Because an NFT is unique, it makes them a poor mode of exchange: the power in currencies lies in the fact that any one can be exchanged for any other one of the same kind. If you have two one-dollar notes in your pocket and you buy a pack of gum that costs $1, you can pay for it with either note, it’s not like the store clerk is going to refuse one but accept the other.

What makes NFTs unattractive as currency makes them very interesting for collectors, though. After all, if something is one of a kind, there is bound to be somebody that wants to own it. It doesn’t matter if it’s a rare coin or even a limited-edition boxed set of a popular video game: rarity can make anything worth coveting.

“Owning” an NFT

However, NFTs have a weird quirk: they aren’t owned outright. For instance, if you shelled out $8 million for the world’s rarest stamp , you’d own the tiny piece of paper. It’d be in a temperature-controlled glass case in the library of the massive mansion we assume millionaire collectors own.

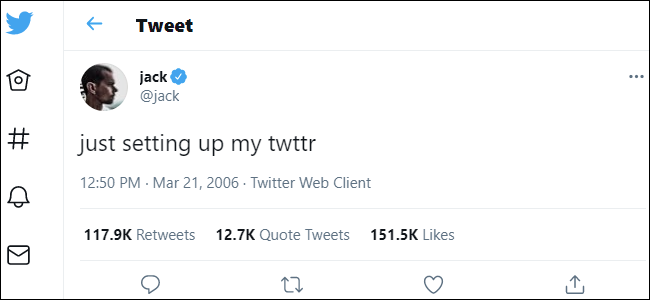

This stands in sharp contrast to NFTs, which aren’t owned. For example, Malaysian businessman Sina Estavi bought Twitter founder Jack Dorsey’s very first tweet for almost $3 million. Here’s a copy of that tweet.

Now, it’s not like How-To Geek had a couple million bucks laying around and bought the tweet from Mr. Estavi, or even licensed it from him. We just copied the tweet and then uploaded it to our own site. You could do the same: just right-click, hit “Save Image,” and you’re the proud owner of a poorly spelled tweet. You wouldn’t be breaking any laws or anything.

Certifiably Crazy

This is because Mr. Estavi doesn’t actually own the tweet, he owns a certificate of authenticity that states he is the owner of the tweet. In real-world terms, it’s like buying the deed for a house but not the house itself—and you paid the same for the deed as for the house.

Technically, NFTs are protected under copyright. Harry Richt , a lawyer based in New York City, told us via email that “by default, the author of an NFT retains all the exclusive rights, including the right to create copies of the work […] the purchaser of the NFT gains the right to display or sell that particular NFT.” According to Mr. Richt, the author also has the right to go after people that infringe on that copyright.

Another lawyer we spoke to, Max Dilendorf , also from New York, said much the same, though emphasized in particular that the intellectual ownership of NFTs is “a contractual question, depending on the platform” you buy the NFT from. Different platforms have different rules regarding copyright.

According to this paper from the Cypriot law firm of G.C. Hadjikyprianou the same issues exist in the EU, so it’s not like it’s any more definitive on the other side of the Atlantic.

Lawsuits are few and far between, though: Slate ran an article recently going over all the shenanigans people have been up to with these tokens, and so far nobody has been sued.

For instance, there’s seemingly nothing stopping you from copying an image from the Bored Ape Yacht Club , a club of NFT owners which includes millionaire celebrities like Post Malone or Jimmy Fallon. You won’t be in the club, but you can thumb your nose at some rich people, which is fun.

We took this from the Bored Ape Yacht Club site, for example.

We took this from the Bored Ape Yacht Club site, for example. Sure, they might get angry with you, but there’s precious little they can do except complain at you on Twitter.

(Editor’s note: Of course, images are protected under copyright whether they’re NFTs or not—but, as we are including the image in this article to comment on the image itself, this is covered under fair use.)

In fact, one enterprising soul even set up the NFT Bay—clearly a wink at torrenting hotspot The Pirate Bay—where you can upload and download whatever NFTs you’d like. We doubt NFT owners are thrilled, but, lacking a legal framework, there’s little they can undertake to stop it.

Securing the Insecurable

It’s not just people capitalizing on the obsession with NFTs that are ruining the fun for aficionados, either, there are also some legitimate security concerns when it comes to the digital tokens, issues which have seen them banned from Steam , for example.

For example, Vice ran a story about an NFT platform that was hacked somehow. It’s unclear if the site itself was insecure or if the users in question fouled up, but the upshot is that millions of dollars worth of NFTs were stolen. (Is it theft if you never owned it in the first place?).

However, there’s a second issue, one that’s more serious yet also oddly hilarious. The Verge goes into a lot more detail, but in short, your certificate of authenticity isn’t a certificate as much as a link to a record of your purchase. If the server the links points at goes down, your proof of ownership disappears and you won’t be getting it back.

In essence, there are people out there who’ve put millions into a digital asset that are just one server malfunction away from being wiped out completely. Though we’re no financial experts—the fact that we’re tech writers should serve as evidence of that—entrusting your fortune to some under-caffeinated server technician doesn’t seem like wise estate planning to us.

Brass Tacks

When you add it all up, NFTs seem more like a membership card than anything else. Owning one is like a badge that you belong to a group: maybe it’s just a few people really into sharing a specific piece of art, or maybe it’s to show off that you have money to burn—the ultimate aim of conspicuous consumption throughout the ages.

NFT is no more than a stamp to a philatelist (stamp collector): where most see a colored piece of paper, stamp collectors see value. Where you or I see a bit of code, NFT collectors see something worth having. In a way, it’s just aficionados securing bragging rights, and the value of any NFT is dependent on how valuable it has been made to seem. Though you could wade in for yourself and see what all the fuss is about, if you ask us, the only winning move is not to play.

Also read:

- [New] Leading 5 iOS Podcast Apps Selection

- [New] Unlinking From YouTube Shorts - Easy and Permanent

- [New] Writing That Grabs and Grips Podcast Description Tactics for 2024

- [Updated] 2024 Approved High-Ranked Choices Ideal Online Spots for Grab Snapchat Ringtone

- [Updated] Affordable SkyCabinet Mass Data Hoarding on a Budget for 2024

- [Updated] Blizzard Brilliance Olympic Peaks in Beijing

- [Updated] Cutting Edge Complete Rotation Videography Equipment for 2024

- [Updated] From Black and White to Richness Embracing HDR's Power for 2024

- [Updated] In 2024, Decoding Windows 10'S Secret for File Imports

- 10 Free Location Spoofers to Fake GPS Location on your Realme 12 5G | Dr.fone

- 容易にナビゲートできるようDVDの章ごとに編集する方法

- Convert Your DVDs Into Digital Files with Ease Using Hardware-Assisted Ripping

- Discover the File Path of Your Current Wallpaper

- Expert Hardware Analysis with Tom - Your Trusted Resource

- Opera GX Savings: Extended Nitro for the Cost-Conscious User

- The Secret Sauce to Swipe Right Crafting Captivating Bio on Tinder

- Unveiling Windows Media Seamless CD Extraction

- Title: Exploring Common Issues with the Rise of Digital Asset NFTs

- Author: Edward

- Created at : 2025-01-27 06:51:01

- Updated at : 2025-01-30 16:38:15

- Link: https://vp-tips.techidaily.com/exploring-common-issues-with-the-rise-of-digital-asset-nfts/

- License: This work is licensed under CC BY-NC-SA 4.0.