Utilizing Cookiebot's Capabilities for Advanced Data Tracking and Analysis

Utilizing Cookiebot’s Capabilities for Advanced Data Tracking and Analysis

Talking to Robots

June 21, 2018

There is a great scene in Star Trek IV – The Voyage Home, when Scotty, the Starship Enterprise’s Chief Engineer, having traveled back in time, tries to operate a 1980’s era computer. The movie, made in 1986, accurately predicted the rise of Siri, Alexa and the widespread proliferation of voice-recognition technology. But poor old Scotty, burdened with 1980’s tech, picks up the mouse, using it like a microphone, saying “Hello computer!”

Figure 1 - Star Trek IV: The Voyage Home (1986)

As futuristic as voice recognition was back in 1986, this illustrates the importance of how we interface with technology. The rise of Business Process Management (BPM) and the more recent ascendancy of both Robotic Process Automation (RPA) and the Internet of Things (IoT) are vital catalysts and enabling technologies that drive Digital Transformation.

For organizations to leverage these powerful tools it is vital that they speak the right language. Moving from the analog to the digital realm, requires that the information contained within business content be digitized.

However, the content needs to be transformed into more than a mere digital facsimile but should also contain information structured in a way that these enabling technologies can both understand and, more importantly, act upon.

Content Intelligence

In order to do this, it is first necessary to classify the nature of the content, i.e. determine what it represents and, therefore, identify the context of the information it contains. This can be achieved by Content Intelligence through utilization of AI algorithms capable of automating this time-consuming activity.

AI-based Classification and Extraction

ABBYY’s FlexiCapture platform incorporates and AI-based auto-classifier. This can be trained to autonomously recognize different types of documents. This evaluates both image and textual information contained in the content. These mechanisms can be deployed either independently or in combination in order to maximize accuracy and performance.

Once the nature of the content is identified, it is then necessary to determine the structure of the information that is required. FlexiCapture locates, validates and extracts this information inside the content.

If all the documents of a particular type were identical, e.g. copies of the same underlying form, this would be relatively simple we could use the geospatial co-ordinates of the fields on the form and extract the information from a predefined region of the form. However Digital Transformation is not merely restricted to identical fixed format forms, but content existing in many diverse formats, e.g. different vendor invoices and bank statements from various financial institutions.

The ability to accommodate such diversity comes from a combination AI and business rules to identify, extract and validate the information within the content regardless of the specific layout. The accuracy of the information is maximized through additional validation with external databases, e.g. a vendor database for invoices.

Machine Learning

While a degree of training is necessary during implementation, the system also “self-trains” as an inherent part of the systems normal operations. It does this by incorporating the input from data verification operators.

This ensures that the accuracy of the information extracted is maintained at an acceptable level and not adversely affected by changes to the formatting of the documents being processed, e.g. where a vendor changes the format of their invoices.

What this all means is, that the original content, through Content Intelligence, is now able to speak the right language to technologies such as BPM, RPA and IoT.

Example: Setting Up E-Bill Payment

One of the advantages of web-based banking, is the ability of customers to take control of banking transactions that used require talking to a representative of the bank.

If a customer wishes to set up an automatic payment to, for example, their Electricity provider, they need to enter a variety of information regarding the provider and their account information.

The customer can use their Electricity Bill to initiate and automate the setup of an electronic bill payment.

Paperless Billing

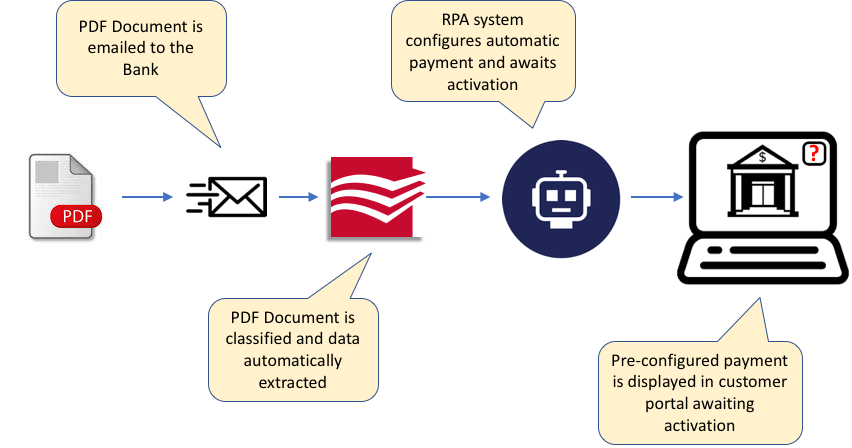

Today, many customers can have gone “paperless” and can receive their bill as a PDF (typically downloaded from a customer portal). In this scenario, customers can email the utility bill to their bank as shown below in Figure 2.

Figure 2 - Setting up e-Billing via e-Mail

Once the bank, receives the email, FlexiCapture processes the attachment, automatically identifying the document as a utility bill and extracting the necessary billing information, including the utility company’s customer account number along with account number of where the payment needs to be made to.

This extracted information is passed to an RPA application to configure the automated payment and await final activation. Given that the request came in via email, the customer is notified via their Customer Banking Portal and is prompted to confirm the activation of the automatic payment.

Paper-based Billing

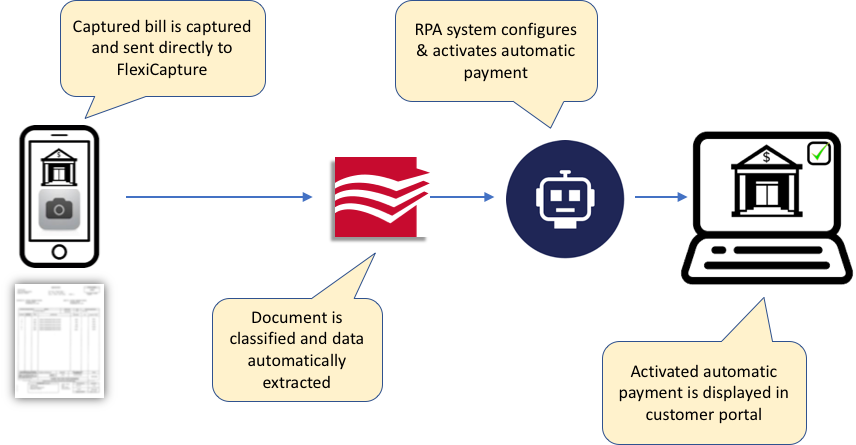

Not all customers of vendors avail themselves of paperless billing. Consequently, a mechanism is required to automatically extract information from a paper bill in a manner that enhance the total customer experience.

In this use case, customer can capture the paper bill directly from their mobile banking app and send the resulting image directly to FlexiCapture as shown below in Figure 3.

Figure 3 - Setting up e-Billing via Mobile Banking App using paper-based bill

FlexiCapture processes the attachment, automatically identifying the document as a utility bill and extracting the necessary billing information, including the utility company’s customer account number along with account number of where the payment needs to be made to.

This extracted information is passed to an RPA application to configure the automated payment and activates it, given that the request already originated via the customer’s bank app.

The activated automated payment is then displayed in the customer banking portal.

Accelerate Digital Transformation by Speaking the Right Language

By speaking the right language, it is possible to transition seamlessly from the Analog to the Digital Realm. This can enable Bank and all other organization provide the level of synchronous and near synchronous transaction that today’s customers demand

by Carl Hillier, Product Group Head for Data Capture

Like, share or repost

Share

Subscribe for blog updates

First name*

E-mail*

Сountry*

СountryAfghanistanAland IslandsAlbaniaAlgeriaAmerican SamoaAndorraAngolaAnguillaAntarcticaAntigua and BarbudaArgentinaArmeniaArubaAustraliaAustriaAzerbaijanBahamasBahrainBangladeshBarbadosBelgiumBelizeBeninBermudaBhutanBoliviaBonaire, Sint Eustatius and SabaBosnia and HerzegovinaBotswanaBouvet IslandBrazilBritish Indian Ocean TerritoryBritish Virgin IslandsBrunei DarussalamBulgariaBurkina FasoBurundiCambodiaCameroonCanadaCape VerdeCayman IslandsCentral African RepublicChadChileChinaChristmas IslandCocos (Keeling) IslandsColombiaComorosCongo (Brazzaville)Congo, (Kinshasa)Cook IslandsCosta RicaCroatiaCuraçaoCyprusCzech RepublicCôte d’IvoireDenmarkDjiboutiDominicaDominican RepublicEcuadorEgyptEl SalvadorEquatorial GuineaEritreaEstoniaEthiopiaFalkland Islands (Malvinas)Faroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaFrench Southern TerritoriesGabonGambiaGeorgiaGermanyGhanaGibraltarGreeceGreenlandGrenadaGuadeloupeGuamGuatemalaGuernseyGuineaGuinea-BissauGuyanaHaitiHeard and Mcdonald IslandsHoly See (Vatican City State)HondurasHong Kong, SAR ChinaHungaryIcelandIndiaIndonesiaIraqIrelandIsle of ManIsraelITJamaicaJapanJerseyJordanKazakhstanKenyaKiribatiKorea (South)KuwaitKyrgyzstanLao PDRLatviaLebanonLesothoLiberiaLibyaLiechtensteinLithuaniaLuxembourgMacao, SAR ChinaMacedonia, Republic ofMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesia, Federated States ofMoldovaMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNamibiaNauruNepalNetherlandsNetherlands AntillesNew CaledoniaNew ZealandNicaraguaNigerNigeriaNiueNorfolk IslandNorthern Mariana IslandsNorwayOmanPakistanPalauPalestinian TerritoryPanamaPapua New GuineaParaguayPeruPhilippinesPitcairnPolandPortugalPuerto RicoQatarRomaniaRwandaRéunionSaint HelenaSaint Kitts and NevisSaint LuciaSaint Pierre and MiquelonSaint Vincent and GrenadinesSaint-BarthélemySaint-Martin (French part)SamoaSan MarinoSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSingaporeSint Maarten (Dutch part)SlovakiaSloveniaSolomon IslandsSouth AfricaSouth Georgia and the South Sandwich IslandsSouth SudanSpainSri LankaSurinameSvalbard and Jan Mayen IslandsSwazilandSwedenSwitzerlandTaiwan, Republic of ChinaTajikistanTanzania, United Republic ofThailandTimor-LesteTogoTokelauTongaTrinidad and TobagoTunisiaTurkeyTurks and Caicos IslandsTuvaluUgandaUkraineUnited Arab EmiratesUnited KingdomUnited States of AmericaUruguayUS Minor Outlying IslandsUzbekistanVanuatuVenezuela (Bolivarian Republic)Viet NamVirgin Islands, USWallis and Futuna IslandsWestern SaharaZambiaZimbabwe

I have read and agree with the Privacy policy and the Cookie policy .

I agree to receive email updates from ABBYY Solutions Ltd. such as news related to ABBYY Solutions Ltd. products and technologies, invitations to events and webinars, and information about whitepapers and content related to ABBYY Solutions Ltd. products and services.

I am aware that my consent could be revoked at any time by clicking the unsubscribe link inside any email received from ABBYY Solutions Ltd. or via ABBYY Data Subject Access Rights Form .

Referrer

Last name

Query string

Product Interest Temp

UTM Campaign Name

UTM Medium

UTM Source

ITM Source

GA Client ID

UTM Content

GDPR Consent Note

Captcha Score

Page URL

Connect with us

- Title: Utilizing Cookiebot's Capabilities for Advanced Data Tracking and Analysis

- Author: Edward

- Created at : 2024-08-22 07:27:33

- Updated at : 2024-08-23 07:27:33

- Link: https://vp-tips.techidaily.com/utilizing-cookiebots-capabilities-for-advanced-data-tracking-and-analysis/

- License: This work is licensed under CC BY-NC-SA 4.0.

.png) Kanto Player Professional

Kanto Player Professional DLNow Video Downloader

DLNow Video Downloader